Risk History

Shinta D.S. MacDonald

Jakarta 25 May 2016

The word 'Risk' comes from the early Italian, risicare which

means 'to dare'. In this sense, risk is a choice, rather than fate.

means 'to dare'. In this sense, risk is a choice, rather than fate. We wish to know why people of the past, did –

or did not - try to tame risk. How they approached the task. What modes of thinking and language emerged from their experience and how their activities influenced other events.

During this discussion, we will often refer to games of chance which have an application far beyond the spin of the roulette wheel or the roll of the dice. Many of the sophisticated ideas about managing risk and making decisions have developed from the analysis of the most childish of games. Today we will endeavour to recognise what gambling and investing reveal about risk.

Why is the mastery of risk such a uniquely modern concept? Why did mankind wait many thousands of years leading up to the European Renaissance before breaking down the barriers that stood in the way of measuring and controlling risk?

We begin with a clue:

Gambling

Since the beginning of recorded history, gambling – the very essence of risk taking – has been a popular pastime and often an addiction.

It was a game of chance that inspired Pascal and Fermat's revolutionary breakthrough into the laws of probability. Yet, until that moment, through history people had wagered and played games without using any system of odds that determines winnings and losings today.

The act of risk-taking floated free, untrammelled by the theory of risk management.

Humans have always been infatuated with gambling because it puts us head-to-head against the fates with no holds barred. We enter this daunting battle because we believe we have powerful ally: Lady Luck will interpose herself between us and the fates (or odds) and bring victory to our side.

The earliest-known form of gambling was a  kind of dice game played with what was known as astragalus, or knuckle-bone. This ancestor to today's dice was a squarish bone taken from the ankle of a sheep or deer. It was solid and without marrow and so hard to be virtually indestructible. Egyptian tomb paintings picture games played with astragali dating from 3,500 BCE, and Greek vases show young men tossing the bones in a circle. Although Egypt punished compulsive gamblers by forcing them to hone stones for the pyramids, excavations show pharaohs were not above using loaded dice in their own games.

kind of dice game played with what was known as astragalus, or knuckle-bone. This ancestor to today's dice was a squarish bone taken from the ankle of a sheep or deer. It was solid and without marrow and so hard to be virtually indestructible. Egyptian tomb paintings picture games played with astragali dating from 3,500 BCE, and Greek vases show young men tossing the bones in a circle. Although Egypt punished compulsive gamblers by forcing them to hone stones for the pyramids, excavations show pharaohs were not above using loaded dice in their own games.

Craps, an American invention, derives from various dice games brought into Europe via the Crusades. Those games were usually referred to as "hazard" from al zahr, the Arabic word for dice. [1]

Losing streaks and winning streaksGamblers may think they are betting on red, or seven, or four-of-a-kind, but in reality, they are betting on the clock.

Away from the gaming tables, the managers of insurance companies conduct their affairs in the same fashion. They set their premiums to cover the losses they will sustain in the long run; but when earthquakes, tsunamis and fires, all happen about the same time, the short run can be very painful. Unlike gamblers, insurance companies carry capital, and put aside reserves to tide them over during their inevitable sequences of short runs of bad luck.

Time matter most when decisions are irreversible. Yet many irreversible decisions must be made on the basis of incomplete information. Should I take a taxi or take a bus; build an automobile factory in Bangkok or Brazil; to changing jobs; to declaring war.

If we buy a stock today we can always sell it tomorrow. But what if do we do after the croupier at the roulette table cries "No more bets" or after a poker bet is doubled? There is no going back. Should we refrain from acting, in the hope that the passage of time will make luck, or the probabilities, turn in our favour?

Marcus Porcius Cato 234 BCE – 149 BCE Roman statesman, was quoted as saying 'He who hesitates is lost - implying that too much hesitation in the face of uncertain outcomes is bad. [2]

implying that too much hesitation in the face of uncertain outcomes is bad. [2]

Yet once we act, we forfeit the option of waiting until more information comes along. The more uncertain the outcome, the greater maybe the value of procrastination. Cato had it wrong: He who hesitates is halfway home.

Jack Benny, the late American comedian, had a routine on a Sunday radio show in which he remained silent when confronted by a pistol packing thief demanding "Your money or your life!" After a long pause, the thief cried "Come on! Your money or your life!". Benny replied, "I'm thinking it over".

To explain the beginning of everything, Greek mythology stated, three brothers rolled dice for the universe. Zeus; won the heavens, Poseidon; the seas, and the looser; Hades, going to hell as master of the underworld.

Probability theory seems a subject made to order for the Greeks, given their zest for gambling, their mathematical skills, their mastery of logic and their obsession with proof. Yet though the most civilised of the ancients, they never ventured into that fascinating world. Their failure to do so is astonishing because the Greeks had the only recorded civilization up

to that point, not dominated by the priesthood, that claimed a monopoly on the powers to forecast the future.

to that point, not dominated by the priesthood, that claimed a monopoly on the powers to forecast the future.

Civilization, as we know it, might has progressed at a much faster pace if the Greeks had anticipated what their intellectual descendants – the men of the Renaissance - were to discover some thousand years later.

Genuflection [bend your knee and bow submissively] before the winds, was the only form of risk management that caught their attention. It is true that Archimedes invented the lever, and claimed; he could move the earth, if only he could find a place to stand.

The greatest contribution of the Greeks was not in scientific innovation. After all, the temple priests  of Egypt knew a good deal about geometry before Euclid came along. Even the famous theorem of Pythagoras: The square on the hypotenuse of a right-angle triangle, is equal to the sum of the squares on the other two sides, - was in use in Tigris-Euphrates valley as early as 2,000 BCE.

of Egypt knew a good deal about geometry before Euclid came along. Even the famous theorem of Pythagoras: The square on the hypotenuse of a right-angle triangle, is equal to the sum of the squares on the other two sides, - was in use in Tigris-Euphrates valley as early as 2,000 BCE.

The unique quality of the Greeks was the insistence on proof. 'Why' mattered more to them than 'What?' The Greeks could reframe the ultimate questions, because theirs was the first civilization in history, to be free of the intellectual straightjacket imposed by an all-powerful priesthood.

More worldly, the Greeks refused to accept at face value the rule of thumb, that older societies passed on to them. They were not interested in samples. Their goal was to find concepts that would apply everywhere and in every case. For example, the mere measurement would confirm that the square on the hypotenuse of a triangle is equal to the sum of the squares on the other two sides – but the Greeks wanted to know why should this be so?

Proof is what Euclidian geometry is all about. And proof, not calculation, would dominate the theory of mathematics forever after.

Again, why was it the Greeks failed to discover the laws of probability and calculus and even simple algebra?

Perhaps, despite all they had achieved, they had to contend on a clumsy numbering system, based on their alphabet. The Romans suffered from the same handicap. A simple number such as 8 required four letters (VIII). The Romans could not write 32 as III II, because people would have no way of knowing whether it meant 32, 302, 3020, or some larger combination of 3, 2 and 0. Calculations based on this system were impossible.

The discovery of a superior numbering system would not occur until about 500 CE when the Hindus developed the numbering system we use today.

The great English economist, John Maynard Keynes (1883–1946) said: "When the capital development of a country becomes the by-product of the activities of a casino, the job is likely to be ill-done". [3]

Yet the world would be a dull place if people lacked conceit and confidence in their own good fortune - Nobody takes a risk.

When the Soviets tried to administer uncertainty out of existence through Government fiat and planning, they choked off social and economic progress.

Hindu-Arabic Numbering SystemThe centrepiece of the Hindu-Arabic numbering system was the invention of zero – sunya as the Indians called it, and cifr as it was known in Arabic. The term has come down to us as cipher which means empty, and refers to the empty column in the abacus or counting frame.

Concepts of zero are difficult to grasp for people who are used to counting only to keep track of the number of animals killed, or the number of days passed, or the number of units travelled. Zero has nothing to do with what counting was for, in that sense.

"The point about zero is, that we do not need it in the operations of daily life. No one goes out to buy zero fish. Its use is only forced upon us by the needs of cultivated modes of thought". Stated by English philosopher and mathematician, Alfred North Whitehead (1861–1947).

Zero revolutionised the old numbering system in two ways.

First: It meant people could use only 10 digits, from zero to 9 to perform every conceivable calculation, and to write any conceivable number.

Second: It meant that a sequence of numbers like 1, 10, 100, would indicate the next number in the sequence would be 1,000. Try that with Roman numerals I, X C or with V, L and D – what are the next numbers in those sequences?

al-Khowarizmi The earliest known work in Arabic arithmetic was written by Persian Muhammad ibn Musa al-Khowarizmi, an orthodox Muslim  mathematician, astronomer, astrologer, geographer, and a scholar from the House of Wisdom in Bagdad [now in Iraq since 1932]. He lived around 825 CE. Although few people know of his work, we know of him indirectly, as his name has evolved into 'algorithm' meaning rules for computing.

mathematician, astronomer, astrologer, geographer, and a scholar from the House of Wisdom in Bagdad [now in Iraq since 1932]. He lived around 825 CE. Although few people know of his work, we know of him indirectly, as his name has evolved into 'algorithm' meaning rules for computing.

al-Khowarizmi was the first mathematician to establish rules for; adding, subtracting, multiplying and dividing, with the new Hindu numerals. He published an article called Hisab al-jahr w'almuqabalah or Science of transposition and cancellation. He specifies the process for manipulating algebraic equations. The word al-jahr gives us our word algebra, the science of equations.

By the year 1,000 CE, the new numbering system was being popularised by Islamic Universities in Spain and elsewhere by the Islamic Saracens in Sicily.

However, the new numbers were not widely used until the 13th century. Introduction of the Hindu-Arabic numbering system provoked widespread resistance, up to the early 1500's.

This was caused by:

1) Inertia from forces resisting any form of change.

2) It was easier to commit fraud with the new numbers. Turning a 0 into a 6 or 9 was temptingly easy, and a 1 could be converted to a 7.

Although the new numbers gained a foothold in Italy where education levels were high, Catholic Florence issued an edict in 1229, that forbade bankers from using the 'infidel' symbols. As a result, many people who wanted to learn the new system had to disguise themselves as Moslems, in order to do so.

The introduction of the metal moveable-type printing press to Europe by Johannes Gutenberg (c.1400-1468), of Mainz, Germany, around 1450, was the catalyst that finally overcame opposition to the full use of the new numbers. Gutenberg was the first to create his type pieces from an alloy of lead, tin and antimony, which remained the standard for 500 years.

However, it should be noted that the world's first moveable type printing press for printing paper books, was invented around 1040 CE in China, during the Northern Song Dynasty by Bi Sheng (990-1051). It used porcelain material for type.

Now al-Khowarizmi's multiplication tables, became something that all schoolchildren had to learn, forever after.

Girolamo Cardano c.1500 - 1571By the time of the Renaissance, everyone was caught up in experimentation. Someone who threw a slot of dice would be interested in the regularities that turned up over time.

Such a person was a physician Girolamo Cardano, whose credentials as a gambling addict alone would justify his appearance in the History of Risk, but he demonstrated extraordinary talents in other areas as well.

Cardano was born in Milan about 1500. He was one of the first people to leave an autobiography. The book was called De Vita Propria Libre (The Book of My Life)

He boasted "I was ever hot tempered, single-minded, and given to women". As well as; "cunning, crafty, sarcastic, diligent, impertinent, sad, treacherous, magician and sorcerer, miserable, hateful, obscene, lying, and fond of the prattle of old men".

Cardano was a gambler's gambler. He confessed to immoderate devotion to the table games and dice: "During many years, I have played not on and off, but, as I am ashamed to say, every day." He lost large sums often enough to conclude that: "The greatest advantage from gambling comes from not playing at all."

He was probably the first person in history to write a serious analysis on the game of chance.

Cardano was a lot more than a gambler and a part time mathematician. He was the most famous physician of his age. The Pope and Europe's royal and imperial families eagerly sought his advice.

He provided the first clinical description of typhus, wrote about syphilis, and developed a new way to operate on hernia.

He recognised that "A man is nothing but his mind; if that be out of order, all's amiss, and if that be well, the rest is at ease.

He was an early enthusiast for bathing and showering.

Cardano was a busy man. He wrote 131 printed works, claims to have burnt 170 more before publication, and left 111 in manuscript form, at his death.

He had two sons, both of which brought him misery. His eldest and favourite called Giambattista, married a disreputable girl who was unfaithful to him. None of her three children, according to her own admission, had been fathered by her husband. Desperate after three years of hellish marriage, Giambattista ordered his servant to bake a cake with arsenic in it. He then fed it to his wife, who promptly died.

Cardano did everything he could to save his son, but Giambattista confessed to the murder and was beheaded.

The younger son Aldo, robbed his father repeatedly, and was in and out of jail at least eight times.

Cardano also had a young protégé called Ferrari. At the age of 14, Ferrari came to live with Cardano, devoted himself to the older man, and referred to himself as 'Cardano's Creation'. Some authorities believe he was responsible for many of the ideas that were attributed to Cardano.

But Ferrari provided little solace for the tragedy of Cardano's own sons. A free-spending, free-living man, Ferrari lost all the fingers on his right hand in a barroom brawl, and died from poisoning – either by his sister or by her lover – at the age of 43.

Cardano's great book on mathematics, Ars Magna (The Great Art) appeared in 1545, at the same time as Copernicus (1473 - 1543) was publishing his discoveries of the planetary system, placing the Sun, rather than the Earth, at the center of the universe.

The book was published just 5 years after the first appearance of the symbols ' + ' and ' - ' in: Grounde of Artes in 1543 by an Englishman named Robert Recorde (1512 -1558).

Seventeen years later an English book called Whetstone of Witte, also by Robert Recorde, introduced the symbol ' = ' because no two things can be more equal, than a pair of parallels. [4]

Cardano's article on gambling is titled Liber de Ludo Aleae (Book on Games of Chance). The word 'aleae' refers to games of dice.

Cardano defined for the first time, what is now the conventional format for expressing probability, as a fraction of possible outcomes, divided by the 'circuit' – that is; the total number of possible outcomes.

For example, if we say the probability of throwing heads is 50/50, heads being one of two equally likely cases. The probability of drawing a queen from a full deck of cards is 1/13, as there are four queens in a deck of 52. The chance of drawing the queen of spades however, is 1/52, because the deck holds only one queen of spades.

Blaise Pascal 1623 - 1662 Pascal was born in the wake of the religious wars of the sixteenth century. Pascal spent

half his life torn between pursuing a career in mathematics, and yielding to religious convictions that were essentially anti-intellectual. Although he was a brilliant mathematician, and proud of his accomplishments as a 'geomaster' his religious passion eventually came to dominate his life.

half his life torn between pursuing a career in mathematics, and yielding to religious convictions that were essentially anti-intellectual. Although he was a brilliant mathematician, and proud of his accomplishments as a 'geomaster' his religious passion eventually came to dominate his life.

Pascal was a child prodigy. At the age of 16 he wrote a paper on The mathematics of the cone. The paper was so advanced that even the great Descartes was impressed with it.

The enthusiasm for mathematics was a convenient asset for Pascal's father, who was a mathematician in his own right, and earned a comfortable living as a tax collector, a function known at the time as a tax farmer.

The tax farmer would advance money to the Monarch – the equivalent of planting his seeds – and then go about collecting it from the citizenry – the equivalent of gathering the harvest, with the ultimate goal as with all farmers, that it would exceed the cost of the seeds.

While Pascal was still in his early teens, he invented and patented a calculating machine to ease the dreary task of adding up M. Pascal's daily accounts. The machine which had gears and wheels, which went forward and backward, to add and subtract. Young Pascal even managed to multiply and divide on his machine. He even started work on a method to calculate square roots, but unfortunately for the clerks and bookkeepers of the next 250 years, he was unable to market his invention, because of prohibitively high production costs.

In 1646 his father fell on the ice and broke his hip. The bonesetters called in to take care of M. Pascal happened to be members of a Catholic sect called Jansenists, whose prime task was to convert wayward Christians to their order. They preached that; emotion and faith were all that mattered - and reason blocked the way to redemption.

After repairing the hip of Pascal senior, the Jansenists stayed on for three months to work on the soul of Pascal Junior, who accepted their doctrine with enthusiasm.

Now Blaise Pascal abandoned both mathematics and science, along with the pleasures of his earlier life, as a man about town. Religion commanded his full attention. His passion for religion caused him to succumb to partial paralysis. His doctors, as a cure suggested he rouse himself, and resume his pleasure-seeking ways.

He lost no time in taking their advice, and soon his pleasure-seeking ways exceeded his former indulgences, and he became a regular visitor to the gambling tables of Paris.

In November 1654 Pascal underwent some kind of mystical experience. He sewed a description of the event into his coat so he could wear it next to his heart, claiming 'Renunciation. Total and sweet'. He abandoned mathematics and physics, swore off high living, dropped his old friends, sold all his possessions except for his religious books, and took up residence in the monastery of Port-Royal in Paris. He died in 1662. [5]

Sampling We all have to make decisions on the basis of limited data. One sip, even a sniff of wine, determines whether the whole bottle is drinkable. Courtship with a future spouse is shorter than the  lifetime that lies ahead.

lifetime that lies ahead.

A few drops of blood may evidence samples of DNA that will either convict or acquit an accused of murder. Public opinion pollsters interview 2,000 people to ascertain the entire nations mind. The Dow Jones Industrial Average consists of just 30 stocks, but we use it to measure changes in trillions of dollars of wealth owned by millions of families and thousands of financial institutions. George H.W. Bush, needed just a few bites of broccoli to decide that the stuff was not for him.

Most critical decisions would be impossible without sampling. By the time you have drunk a whole bottle of wine, it is a little late to announce that is, or is not, drinkable. The doctor cannot draw all your blood before deciding what medicine to prescribe, or before checking out your DNA. The President cannot take referendums of 100% of all voters every month, before deciding what the electorate wants. Nor could George Bush senior eat all the broccoli in the world before expressing his distaste for it.

John Graunt 1620 - 1674

A small book was published in London in 1662, entitled Natural and Political Observations made upon the Bills of Mortality by John Graunt. The book contained a compilation of births and deaths in London from 1604 to 1661, along with an extended commentary interpreting the data. This little book was a stunning breakthrough, a daring leap into the use of sampling methods and the calculation of probabilities – the raw material for every method of risk management, from insurance, and the measurement of environmental risks, to the design of the most complex derivates. [6]

We do not know what inspired Graunt to undertake his compilations of births and deaths in London. He may well have invented the concept of market research, and he surely gave the Government its first estimate of the number of people available for military service.

The manner in which he analysed the data, laid the foundation for the science of statistics. The word 'statistics' is derived from the analysis of quantitative facts about the state.

The raw material that Graunt gathered was contained in Bills of Mortality that the City of London had started collecting in 1603. That was only incidentally the year in which Queen Elizabeth I died. It was also the year that London suffered one of the worst infestations of the plague.

He noted that in 1603, 82% of all burials were of plague victims. He calculated that between 1604 and 1624, about 36% of all children born, died before they reached 6 years of age.

He noted that few are starved, and that; 'beggars swarming up and down upon this city . . . . seem to be most of them healthy and strong'. He recommends that the state; 'keeps them' and that they are be taught to work; 'each according to his condition and capacity'.

He notes that most of the deaths recorded from ulcers and sores were in fact caused by venereal disease, referred to at the time as the 'French Pox'. Moreover, only the Church of England christenings were recorded, which meant that Dissenters and Catholics were excluded.

Graunt made the first reasoned estimate of the population of London, which he concluded was approx. 384,000, which may have been too low, but probably closer to the mark than the assumption at the time of two million.

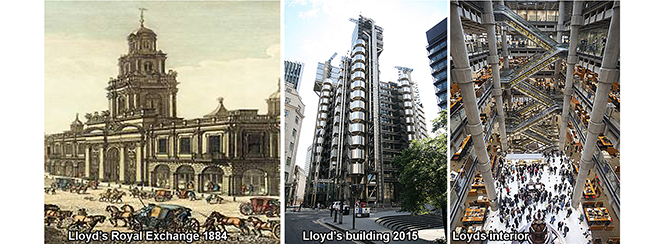

Edward Lloyd c 1648 - 1713One afternoon in 1637 when Graunt was just 17 years old, a certain scholar from Crete named Nathaniel Canopius, sat down in his chambers at Balliol College, Oxford, and made himself a cup of strong coffee. Canopius' brew is believed to mark the first-time coffee was drunk in England. It proved so popular when it was offered to the public, hundreds of coffee houses were soon in operation all over London.

What does coffee have to do with Graunt and the concept of risk? Simply that a coffee house was the birthplace for Lloyd's of London, which for two centuries was the most famous of all insurance markets.

Insurance is a business that is totally dependent on the process of; sampling, averages, independent observations, and the notion of normal, that motivated Graunt's research into London's population.

The second half of the seventeenth century was also an era of burgeoning trade. The Dutch were the dominant commercial power at the time, and England was their main rival. Ships arrived and departed daily in London.

Edward Lloyd came to London, from Canterbury in about 1680, aged 32, with his wife Abigail. Their eldest son Edward, had recently died, and their third daughter Mary had just been born. [7]

The City of London at this time, consisted of two worlds; ships and money. Both converged in a tiny area between the Tower of London and Thames Street, close to the Navy Office in Seething Lane, where Samuel Pepys had worked. Each coffee house had a specialist interest. It was here in now-lost Tower Street, that Lloyd opened his own coffee house, and began attracting all those concerned with shipping. The place became a favourite haunt of ship's captains, merchants and ship owners.

What made this coffee house stand out, is that Lloyd understood the vast importance of information to business. He went out of his way to supply it, publishing a regular newsletter on ships, cargo, and foreign events, and establishing a network of correspondents in ports across Europe.

The first mention of Lloyd's is a reference in the London Gazette of 1688, when Lloyd was 40, announcing a reward for the return of five stolen watches.

By 1691 business was booming, and Lloyd moved to 16 Lombard Street, across from the Royal Exchange and in the heart of the merchants' quarter. The new coffee house would have had a large interior room, with a sanded wooden floor, a bar, with tables with chairs and benches.

Lloyd's staff consisted of three men and two girls, dispensed coffee, tea and sherbet [a fruit punch], and saw that the regulars had pens, ink and paper.

Lloyd by now conducted regular candle auctions. This was an exciting business, where bidding on ship’s cargos began when the stub of a candle was lit. The winning bid was the last one before the candle guttered. Lots included 'a parcel of Turkish coffee' and '53 hogshead of extraordinary neat Red French Wines'.

Lloyd had made a name for himself. His high standing in the community was shown in his election as a sidesman – greeting the congregation at St. Mary Woolnoth, an Anglican church, in Lombard Street. He became a Constable and Questman, an early form of neighbourhood watch, and was later proposed as a councillor. His failure to be elected was probably due to ill health.

Early in 1713, Lloyd made a will, assigning the coffee house lease to his head waiter, William Newton. Two days later Newton married Lloyd's youngest daughter, 19-year-old Handy.

Within another fortnight Lloyd was dead.

It was rare at that time for newspapers to mention the deaths of private citizens, but the Flying Post did so. On Sunday last Died Mr Lloyd, the Coffee-Man in Lombard Street.

For Lloyd, who gave everything to his illustrious meeting place, this would have been enough. How could he guess at what followed; that a world-renowned force for progress, innovation and security had been founded in one small coffee shop – now known as Lloyds of London; a specialist market (not an insurance company) where members join together as syndicates, to insure risks.

Francis Galton 1822 – 1911

Galton was an English Victorian statistician. He was knighted in 1909. Galton produced over 340 papers and books. He also created the statistical concept of correlation and widely promoted regression toward the mean, and standard deviation.

As the initiator of scientific meteorology, he devised the first weather map, proposed the theory on anticyclones, and was the first to establish a complete record of short-term climatic phenomena on a European scale.

He was Charles Darwin's half-cousin. Galton was by many accounts a child prodigy – he was reading by the age of two; at age five he knew substantial Greek, Latin and long division; and by the age of six had moved to adult books, including Shakespeare and poetry. Later in life, Galton would propose a connection between genius and insanity, based on his own experience.

In 1853 Galton met and married Louisa Jane Butler. Their union of 43 years was childless.

Harry Markowitz 1927 -

Markowitz, an 91-year-old Jewish American economist, who devised the Modern Portfolio Theory in 1952. It emphasized the importance of portfolios, risk, and the correlations between securities and diversification. His work changed the way people invested. [8]

A Markowitz-efficient portfolio is one where no added diversification can lower the portfolio's risk for a given return expectation (alternately, no added expected return can be gained without increasing the risk of the portfolio).

He received the John von Neuman Theory Prize in 1989, and the Nobel Memorial Prize in Economic Sciences in 1990.

ConclusionAll the tools we use today in risk management and the analysis of decisions and choice, from game theory, to challenges of chaos theory, stem from developments that took place between 1654 and 1760 - with two exceptions: Francis Galton and Nobel Laureate Harry Markowitz.

Lloyd's of London City Risk Index, explores how the world's cities are increasingly exposed to a number of catastrophic Natural and Man-made risks.

The Risk Market thrives on tradition. At Lloyd's; gentlemen must wear ties; if ships get into trouble, the news is still recorded in a ledger with a quill pen; face to face trading, now so rare elseware in the City, still rules as brokers and underwriters discuss weird and wonderful risks. Its customs and traditions have kept it going for 328 years, since it began in Edward Lloyd's coffee house. [9]